Life Insurance for Commercial Fishermen

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you’re a commercial fisherman, you probably already know that it’s one of the most dangerous occupations there is.

In fact, according to a government source, it’s the second most dangerous general occupational category in America. That can create some complications when it comes to life insurance for commercial fishermen.

Coverage is available, but you should expect extra questions with regard to your occupation, as well as the very real possibility of paying a higher premium.

Fortunately, your occupation is far from the only thing that determines your premium. There are other factors — especially your health, non-occupational habits, and hobbies — that can be even more important.

Why is Life Insurance for Commercial Fishermen Considered High Risk?

For better or worse, commercial fisherman ranks as the second most hazardous occupation in America.

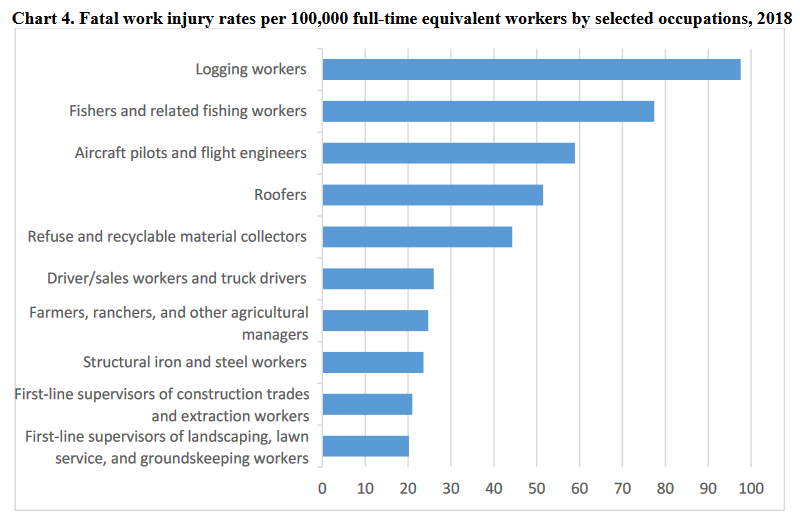

According to the Bureau of Labor Statistics commercial fishermen rank only behind logging workers on the list of 10 most hazardous occupations:

There are reasons why commercial fishing is considered a dangerous occupation for life insurance:

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Work Environment

First is the work environment. You spend an extended amount of time at sea, often in deep seas, which in itself is an unnatural environment for human beings.

Weather

Second is the weather. Not only is the ocean surface subject to radical changes in weather, but the changes often come up quickly and unpredictably.

Ocean Conditions

Third, are conditions in the ocean itself. There can be shifts in currents and other underwater disturbances that can make the work environment very unpredictable. Then, there’s also the fact that you’re working with dangerous fishing equipment, like long lines and automated machinery.

Medical Emergency

Finally, there’s the fact that a medical emergency can take place hundreds or even thousands of miles from the nearest medical facility. It may take many hours or several days of sailing before a suitable medical facility can be reached.

In addition, the typical fishing boat is not equipped for treatment of serious injuries or illnesses.

Insurance companies recognize these multilayered hazards, and must evaluate an application accordingly to adjust for the added risk level presented by the fishing occupation.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Why Life Insurance for Commercial Fishermen May Be Even More Important than Other Occupations

One of the reasons why life insurance is more important for commercial fishermen than most other occupations is the obviously higher risk that comes with the job. But, equally important is that few commercial fishing enterprises provide employer-sponsored life insurance for their employees.

Most fishing is done by small, independent fishing businesses, or even lone fishermen. The industry is highly decentralized, and many people working in the field do so because of either family tradition or geography (such as in states like Alaska and Maine where fishing is an important industry, favored by rich availability of sea life in local waters).

As an owner or employee in the fishing industry, there’s often no availability of group life insurance. And, even when it’s available, it may be prohibitively expensive due to the nature of the work.

If it is provided, it’s generally no more than one or two times a fisherman’s annual salary. That can amount to a relatively small death benefit for the fisherman’s family. It may be little more than sufficient funds to cover final expenses, uncovered medical costs, and to provide for the family for more than a few months.

Even if you are among the rare commercial fishermen who are covered by a group life insurance policy, you almost certainly need to have a private policy to provide additional coverage.

How Insurance Companies Consider Life Insurance for Commercial Fishermen

First, it’s important to understand that life insurance for commercial fishermen is highly specialized. Not all insurance companies offer coverage.

But, it’s also important to realize that every company that does offer life insurance for commercial fishermen will underwrite your application in a somewhat different way. That’s because each takes a different view of the occupation, including the specific risks involved.

Like most occupations, commercial fishing has many different components. A life insurance company will underwrite your application based on the specifics of your particular job.

Some of the considerations included in evaluating the risks of commercial fishermen include:

- The size of the vessel you normally work on. A larger vessel will offer greater protection from dangerous waters, and be more likely to have a medical facility, however limited it might be.

- Whether or not there is medical personnel on board. Your application will receive better consideration if there is.

- Where the majority of your fishing activity takes place. Fishing in waters close to land will have lower risk than deep-sea fishing, largely because of greater access to onshore medical facilities.

- The specific body of water where much of your work takes place. For example, the Bering Sea off the coast of Alaska is notorious as one of the most dangerous bodies of water in the world. If that’s primarily where you work, you’ll pay higher premiums than someone who works in, say, the Gulf of Mexico.

- Do you regularly fish outside American waters? Do your fishing activities take you off the coast of Greenland or into the Norwegian Sea? Or, do you mostly work in the Gulf of Maine?

- How long your employer has been in business.

- Safety and medical equipment typically provided on board by your employer.

- How long you have been working in commercial fishing.

- Special training you have, particularly in water safety.

- The amount of time you spend at sea each year.

Because of the wide variation in each of the above, it’s impossible to generalize premium adjustments for commercial fishermen when it comes to life insurance.

Activity considered to be the lowest risk will carry the lowest premium adjustments.

Non-Occupational Risk Factors May Be More Important than Your Occupation

Even if you work in a high-risk occupation like commercial fishing, other factors will also affect the approval of your application and the premium you’ll pay. Ultimately, your occupation is just one factor, albeit a major one for commercial fishermen.

Non-occupational factors that will be considered in both the approval of your application and setting your premium will include:

- Your age — the older you are, the higher your premium will be.

- Gender — premium rates for females are lower than they are for males.

- Your health — this is typically the single most important consideration determining your premium, even more so than occupation. It will be determined by any chronic health conditions you have or have had in the past.

- The health history of your immediate family, including parents and siblings.

- Smoking, excessive alcohol consumption, or illicit drug use.

- High-risk hobbies — high-risk activities like skydiving, racing, and deep-sea diving will result in a higher premium, sometimes much higher.

- Your driving record — at-fault accidents, multiple moving violations, license suspensions, and especially DUI/DWI episodes.

- Your credit history — significant credit issues can indicate a high stress/high-risk lifestyle.

- Any criminal record you may have.

- Other factors unique to individual insurance companies.

If you fall into the ‘excellent’ category for most or all the above factors, the only premium adjustment you’ll have in your policy will be for your occupation.

Age may be particularly important in relation to your occupation, however. For example, the insurance company may assess that a younger, less-experienced fisherman may be a somewhat greater risk.

At the opposite end of the spectrum, they may consider an older fisherman as a higher risk factor, due to the possibility that age-related limitations may increase the possibility of premature death.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How Much Will Being a Commercial Fisherman Affect Your Premiums?

When underwriting an application for life insurance for commercial fishermen, the insurance company will look first at the risks you pose apart from your occupation. A premium will be determined based on your overall insurance profile, and your occupation considered as an independent risk.

For example, you might purchase a $500,000, 20-year term life insurance policy for a base rate of $600 per year.

The insurance company will then add a flat, dollar amount per thousand to your base premium to adjust for the added risk from your occupation. Typically, that will range between $2.50 per $1,000 to as much as $5 per $1,000.

If the insurance company determines your occupational premium rate increase to be $3 per $1,000, you’ll pay an additional $1,500 per year, or $2,100 when added to the $600 annual base rate. This is calculated by multiplying $3 times 500(000), producing $1,500 for the premium addition.

One of the major advantages of the flat-rate premium adjustment method is that if you ever leave commercial fishing to work in a less hazardous occupation, the adjustments will likely be eliminated.

For example, let’s say that after 25 years as a commercial fisherman, you leave the occupation at age 45 to go into the restaurant business. Since being a restaurant worker is not considered a high-risk occupation, the occupational premium adjustment will be eliminated, and your annual premium will drop down to the base rate of $600 per year.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

How to Apply for Life Insurance for Commercial Fishermen

Anytime you have any kind of additional risk factors associated with your insurance profile, including an especially high-risk occupation like commercial fisherman, it’s always best to work with a life insurance broker.

Brokers have the advantage of working with many different life insurance companies on a regular basis. We know who the insurance companies are that will provide policies for commercial fishermen and other individuals with high-risk factors in their profiles. And among the companies that do provide coverage, we know the ones likely to charge the most favorable premium rates.

By submitting your application with us, we’ll be able to determine, in advance, which companies to place your application with. That will not only give you the benefit of the lowest possible premium, but it will avoid the need for you to make an application with multiple companies, many of whom will decline your application because of your occupation.

Whatever you do, don’t be drawn by advertisements for the cheapest life insurance premiums. Those are designed for young, healthy applicants who work in low-risk occupations. Even if such companies approve your application, it’s likely to be with a much higher premium than they advertise. That’s if they approve your policy at all. Many exist only to provide coverage for the lowest-risk applicants, which is why they offer the lowest premiums in the first place.

If you have a high-risk occupation, or a high-risk health condition, your best and often only strategy is to work with a licensed life insurance broker.

Do-it-yourself shopping for life insurance is not a suitable strategy for a commercial fisherman. Put our experience to work for you, and let us do the legwork to get you the coverage you need.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.