Life Insurance for Construction Workers

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 19, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Did you know that your occupation could affect the premiums you pay for life insurance? And, one of the highest-risk occupations is construction worker.

That’s why life insurance for construction workers requires special handling. It’s not that you’ll be turned down for a policy, but rather that you’ll likely pay a higher premium than someone in a less risky occupation will.

But, rest assured that your occupation as a construction worker is far from the only factor the insurance company will consider in setting your premium.

It’s just one of many, but you’ll need to be aware of it when applying for coverage.

Why is Life Insurance for Construction Workers Considered High Risk?

Because of the nature of the work itself, construction workers are considered one of the highest-risk occupations in general, including by the insurance industry.

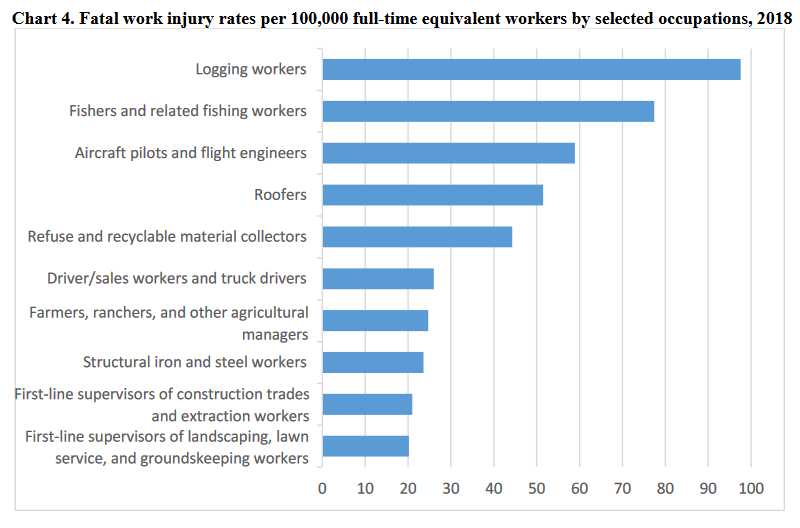

According to the Bureau of Labor Statistics the 10 most hazardous occupations are as follows:

Notice that “first-line supervisors of construction trades and extraction workers” is number nine on the list of 10. It shows a fatality rate of just over 20 per 100,000 full-time equivalent workers in 2018.

Perhaps the biggest single risk to a construction worker is the potential for death from falls. This is a risk since the work is often performed on buildings that are two stories or more. It’s an especially big risk if you work on buildings that are three stories or more, but fatalities are often more about how a person falls than the actual distance.

Apart from falls, there’s also the risk of death from heavy equipment like power tools, as well as electrocution. After all, construction involves working with electrical wires and other devices, even if you are not an electrician. Still, other possibilities are explosions and fires. These can be the result of gas leaks or electrical fires.

Considering all the possibilities, construction workers definitely face more potential hazards than people in other occupations do. Insurance companies will naturally take that into consideration in underwriting your life insurance application.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Why Life Insurance for Construction Workers may be Even More Important than Other Occupations

One of the most important reasons to have your own personal life insurance policy as a construction worker is that the occupation does not universally provide employer-sponsored life insurance coverage.

While coverage may be available if you work through a union, union membership may not be available if you work in a non-union state. That will leave you completely on your own for life insurance.

However, even if you do have work-related life insurance, which is typically provided by unions themselves, the death benefit will be limited. At most, you’ll be able to get $200,000 of coverage. And there may be limits to how much of that your beneficiaries will collect. For example, while they may get the full death benefit if you die at work, it may be a reduced amount if you die off the job.

But even at $200,000, you may still be seriously underinsured. Financial advisors recommend having life insurance sufficient to cover at least 10 times your annual salary. If your average salary is $40,000, that means you’ll need $400,000 in life insurance coverage. Your union coverage, if it’s even available, will cover only half that amount. You’ll need to have a private policy to make up the difference.

There’s still another reason to have your own policy, and that’s termination. Your union-sponsored coverage may only apply as long as you are actively working through the union. Otherwise, your benefit will expire, leaving you completely uninsured.

If you are considering getting a private life insurance policy, you should act now. That’s because you’ll never be younger than you are right now, and you’ll certainly want to get coverage before developing any chronic health conditions.

And, in the type of industry that construction is, the possibility of developing those health conditions — including by injury — is higher than in most other fields.

How Insurance Companies Consider Life Insurance for Construction Workers

While life insurance companies tend to consider construction workers a high-risk occupation across the board, there are varying degrees of how much risk the job involves.

For example, if you work in the office of a construction company in an administrative capacity, you’re unlikely to face any kind of premium increase as a result of your job. And, if you’re a supervisor or manager, there may be only a slight premium increase, if any at all.

But, if you actually perform construction work in your daily activities, you should expect to pay a higher premium. Even that may vary based on specific responsibilities. For example, the insurance company will want to know what your specific job duties are, what type of machinery and tools you work with, and any safety training or precautions that are taken as part of your job.

They’ll also be especially concerned with your work environment. For example, if you normally work in the construction of one- and two-story houses, the risk will be considered lower than if you work in higher structures where the risk of fatal falls will be greater.

Non-Occupational Risk Factors may be More Important than Your Occupation

If you are a construction worker, never assume your occupation will be the only determining factor in your life insurance premium, or even the most important.

When underwriting a life insurance application, insurance companies look for the total risk profile presented by the applicant.

Non-occupational factors that will be considered in the determination of your premium will include the following:

- Your age: the older you are, the higher your premium will be.

- Gender: premium rates for females are lower than they are for males.

- Your health: this is typically the single most important consideration determining your premium, even more so than occupation. It will be determined by any chronic health conditions you have or have had in the past.

- Family Health History: The health history of your immediate family, including parents and siblings.

- Life Choices: Smoking, excessive alcohol consumption, or illicit drug use.

- High-risk hobbies: activities like skydiving, racing, and deep-sea diving will result in a higher premium, sometimes much higher.

- Your driving record: at-fault accidents, multiple moving violations, license suspensions, and especially DUI/DWI episodes.

- Your credit history: significant credit issues can indicate a high stress/high risk lifestyle.

- Any criminal record you may have.

- Other factors unique to individual insurance companies.

If your profile in each of these areas is excellent, you’re likely to get a preferred plus premium rate even as a firefighter. However, if there are any additional risk factors in the above categories, especially those that may have an impact on your occupation, it will affect your premium.

For example, a 50-year-old construction worker is considered higher risk than a 25-year-old. The same is true of an obese construction worker versus one of normal weight. The combination of factors can make the risk of death on the job higher.

Read more: DWI vs. DUI: What’s the difference?

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How Much Will Being a Construction Worker Affect Your Premiums?

There’s no ballpark answer to this question. As you can see from the combination of potential risk factors above, as well as the specific risk level of your job, you’ll generally need to go through the underwriting process to get a reliable premium quote.

Under a best-case scenario, where your job is relatively low risk, there’ll be no additional premium for your occupation.

In a higher-risk classification, you may pay an extra flat fee, such as $2 per $1,000 of coverage. That being the case, a $200,000 policy will add $400 (200 X $2) to the annual cost of your premium. If the regular premium is $500, adding the $400 occupational flat fee will increase your premium to $900 per year. However, the advantage with the flat fee is that it can be removed if you move to a lower-risk job or occupation.

If your occupation involves a significant degree of risk, your premium may be determined by what’s known as a table reading. That’s where the insurance company considers all your risks in combination, and assigns a premium for which they consider the policy acceptable.

In either case, you’ll generally pay less for a life insurance policy that requires a medical exam than one that doesn’t. This is true throughout the life insurance industry, and not just for construction workers. The medical exam gives the insurance company an opportunity to assess your latest health condition, enabling more precise premium pricing. If the policy does not involve a medical exam, the premium will automatically be higher.

A term life insurance policy will usually cost only a small fraction of a whole life policy, since it’s temporary and does not include a cash value accumulation. If you’re looking to save money on your premium, term life is definitely the way to go.

How to Apply for Life Insurance for Construction Workers

If you’re a construction worker, or work in any high-risk occupation or have significant health conditions, you should always work with a life insurance broker. That’s what we are, and the advantage to you is that we work with dozens of different insurance companies. That gives us the ability to match your application with the company that’s likely to take the most favorable view of your insurance profile.

This is a more important strategy than most consumers understand. All insurance companies have their own underwriting criteria with regard to any risk. That includes health conditions, like heart disease, cancer, and diabetes, as well as high-risk occupations and high-risk hobbies and behaviors.

If you have any of these, you’ll need to apply with the right insurance company. That’s the one that’s most likely to approve your policy, and provide the most reasonable premium.

We know exactly which companies will work best in your particular situation. You can waste a lot of time applying for what you believe to be the lowest-cost life insurance providers, only to end up being declined or charged a premium you can’t afford.

Let us do the shopping for you, and we’ll get it right the first time around. You will not pay anything extra for our services, since we are compensated by the insurance companies, not by you.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.