Life Insurance for Steel Workers

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Feb 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Feb 27, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Most consumers know that factors like personal health conditions, your family’s health history, and even certain personal habits (like smoking) and hobbies can have a major impact on your life insurance premiums.

But did you know that your occupation may also be a factor?

That’s certainly not true of all occupations, but there are several that are classified as “high risk” that can impact your premium.

One such high-risk occupation has to do with life insurance for steel workers.

It’s certainly not that you can’t get life insurance for steel workers, but more that there may be certain factors related to your occupation that can result in a higher than normal premium.

Even so, there are ways the premium impact of your occupation can be minimized.

Why is Life Insurance for Steel Workers Considered High Risk?

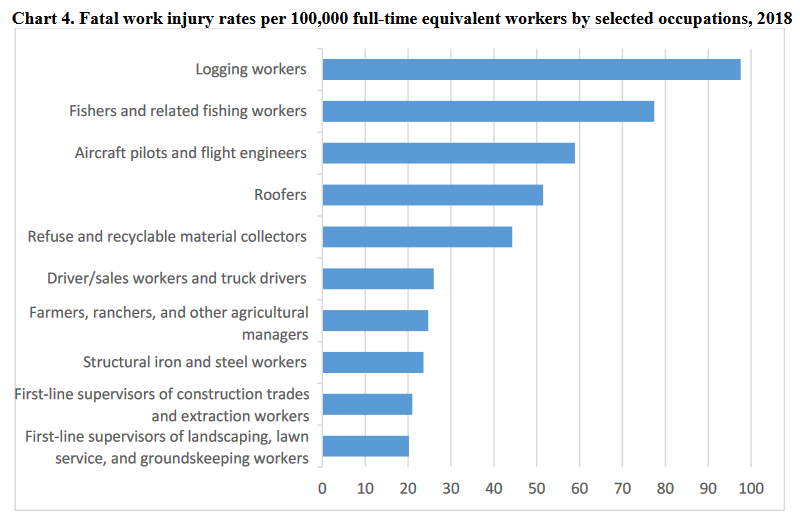

Unfortunately, steel workers rank among the top 10 occupations most at risk for fatal work-related injuries.

According to the Bureau of Labor Statistics steel workers, or more specifically described as structural iron and steel workers, rank as the eighth most hazardous occupation:

Interestingly enough, steel workers are considered to be in a more high-risk occupation than even police and firefighters. (For more information, read our “Life Insurance for Firefighters“).

Some of the reasons why steel workers are considered to be in a hazardous job has much to do with the work environment itself.

Since steelwork is typically required in high-rise buildings, steel workers commonly work well above street level, including hundreds of feet up in the construction of skyscrapers. In doing so, they work with heavy building materials, like steel girders, and often use dangerous equipment.

The altitude of the job holds the obvious potential of falls. It’s not just that the structures workers regularly operate from are minimal, but also that it’s easy to lose balance when you’re standing on a narrow steel bar hundreds of feet off the ground. It’s also possible to lose your balance tripping on construction debris.

Weather is another factor, since much or even most of the work is performed outdoors. That holds the potential for wet or icy environments, in addition to the impact of high winds. And of course, there are always the additional risks posed by faulty power tools or burns from welding activity.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Why Life Insurance for Steel Workers may be Even More Important than Other Occupations

Most financial experts advise having life insurance equal to at least 10 times the amount of your annual income.

If you earn $75,000 per year, you should have at least $750,000 in coverage. That will generally be sufficient to not only cover your final expenses, but also provide for your family’s financial survival after your death.

You may want to add even more to cover college educations for your children or pay off your home mortgage early.

But the problem is that despite the greater likelihood of death for steel workers, employer or union-sponsored policies generally cover no more than two or three times your annual income. That means on a $75,000 income, you’ll have $225,000 in sponsored coverage, at most.

That will still leave you short by at least $525,000. And that’s the part you’ll need to make up with a private life insurance policy.

But don’t worry that you won’t be able to get private life insurance coverage as a steel worker. There are dozens of life insurance companies available, and while not all are necessarily welcoming of high-risk occupations, some are.

More than anything else, it’s a matter of working with those companies that take the most favorable view of a high-risk occupation, like steel workers.

How Insurance Companies Consider Life Insurance for Steel Workers

Insurance companies underwrite life insurance for steel workers in much the same way as they do for applicants in less hazardous occupations.

For example, your application will be underwritten based on the usual factors, including your health condition, your family’s health history, and other factors. They’ll then come up with a base premium rate for your policy.

Your occupation will be considered as a very specific underwriting category. It’s important to understand that life insurance companies don’t judge all steel workers in the same light.

They recognize that there are different degrees of potential hazards, depending on your specific responsibilities, the company or union you work for, and the types of projects you work on.

Specific consideration is given to the following:

- The height of the structures you normally work on. For example, higher premiums typically apply if you regularly work on structures more than 50 feet high, and may be increased for even higher structures.

- Your specific occupation within the field – a supervisor or other worker who doesn’t normally work on high structures may not be charged a higher premium.

- Specific safety procedures employed on the job. For example, you’ll get a lower premium if job sites are routinely equipped with safety equipment, like the nets and harnesses.

- Any training you may have received, including safety-related courses.

- The degree of danger involved in your job. For example, a welder may be charged a higher premium due to the potential of being burned.

- Your personal experience level. A steel worker with 10 years of experience would naturally be considered a lower risk applicant than with only one or two years on the job.

In addition, underwriting may consider your occupation in light of your personal condition. For example, older workers – meaning those over 45 – are considered to be at higher risk. Part of this is due to the physical deterioration that occurs in middle age, but also the onset of any medical conditions that might affect your job.

For example, hypertension or diabetes may increase your risk profile, since either can lead to episodes of dizziness or disorientation or, in the case of hypertension, the potential for stroke.

The onset of any of those situations could cause you to stumble, resulting in a fatal fall.

Non-Occupational Risk Factors may be More Important

As noted at the outset, your occupation as a steel worker is far from the only factor that will affect your application approval and the premium you’ll pay.

Other Factors Include:

- Your age — a 50-year-old will pay a higher premium than a 25-year-old, especially in combination with a high-risk occupation like steel work.

- Gender — because of greater longevity, premiums for women are lower than they are for men.

- Your health — for most applicants, this will be the single most important consideration determining your premium. Any chronic health conditions you have, or previous episodes of major diseases, like cancer, will result in higher premiums.

- The health history of your immediate family, including parents and siblings.

- Personal habits, like tobacco, excessive alcohol consumption, or illicit drug use, will result in higher premiums.

- High-risk hobbies — high-risk activities like deep-sea diving, parasailing, or backcountry skiing, will result in a higher premium.

- Your driving record — at-fault accidents, multiple moving violations, license suspensions, and especially DUI/DWI episodes will result in a higher premium.

- Your credit history — significant credit issues can indicate a high stress/high-risk lifestyle.

- Any criminal record you may have.

If your profile is clean on all or at least most of the above, your premium will only be adjusted higher for your occupation. And once again, there are a number of factors that will determine exactly how much higher that premium will be.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

How Much Will Being a Steel Worker Affect Your Premium?

There’s no definitive answer as to how much higher your premium may be because you are a steel worker. And as discussed above, there may be certain jobs in the field that result in no increase in premium at all.

But assuming that you are engaged in a job that involves a higher degree of risk, mainly performing actual steel work on high-rise buildings, you should expect some level of increase in your premium.

The insurance company will start by calculating a premium rate based on your overall non-occupational profile. For example, let’s say you purchase a 20-year term life insurance policy for $500,000. Based on all factors apart from your occupation, the premium is set at $700 per year.

If your specific job is considered to be high risk, they may add a flat fee extra charge to that premium. The charge can be anywhere from $1 to $5 per thousand of coverage.

If the insurance company assigns your particular job a moderate level of risk, they may set the flat rate at $2.50 per thousand. Since your policy is for $500,000, the occupational premium addition will be $1,250 – $2.50 X 500(000). When added to your $700 base premium level, your total premium will be $1,950 per year.

One of the advantages of this type of pricing structure is that it can be adjusted if your job status changes. For example, if a couple years into the policy, you move into a less hazardous role; the flat fee adjustment may be either lowered or eliminated.

The same would be true if you change occupations. If you move out of steel working into say, teaching at a technical college, the higher premium may be eliminated.

How to Apply for Life Insurance for Steel Workers

When shopping for life insurance, many consumers are drawn to the many ads for very low-cost coverage that pop up regularly on the Internet and even on TV. But as attractive as those ads and rates may be, it’s unlikely you’ll get them as a steel worker. In fact, your application might even be declined because of your occupation.

Very low advertised life insurance premiums are targeted specifically to young, healthy applicants who work in non-hazardous occupations. In many cases, they can’t accommodate applicants who have either serious health conditions or high-risk occupations.

The better course of action for steel workers, and anyone with a higher risk profile, is to work with an insurance broker. As an independent insurance broker, we work with dozens of different insurance companies. Our specialty is working with people who don’t fit the “perfect applicant” profile.

That’s possible because our experience in the industry enables us to match higher risk applicants with the most accommodating insurance company. Not only will that increase the likelihood of your application being approved, but it will also minimize the premium you’ll pay.

You may also be surprised to learn that taking advantage of our services won’t cost you anything extra compared to making direct application with a life insurance company. As brokers, we’re compensated by the insurance companies directly, and at no additional cost to you. That will not only save you money on the premiums, but also the time you would need to spend finding the companies that will work best for steel workers.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.