National General Insurance Review

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Have you heard of National General Insurance? What if I told you there’s an insurance company out there that offers over TEN different discounts?

That’s not all – how about a lifetime guarantee for collision repairs, an emergency expense allowance, and even a theft reward if your vehicle gets stolen?

Well, you’d probably think I was full of it….but you’d be so very wrong!

TABLE OF CONTENTS:

- Auto Insurance

- Home Insurance

- Home Warranty

- Small Business and Commercial Property Insurance

- Health Insurance

- Dental Insurance

- TrioMed Insurance

- Critical Illness Insurance

- Hospital Coverage

- AcciMed Insurance

- Personal Umbrella Insurance

- Discounts

- Smart Services

- Rates

- Pros and Cons

- Claims

- Payment Options

- Customer Reviews

About National General Insurance

National General Insurance, previously known as GMAC, was founded in 1920 as part of General Motors.

So, needless to say, this company knows their cars. This may be a very GOOD reason to consider National General Car Insurance!

…but don’t be fooled. Auto Insurance isn’t the only thing National General Insurance offers! I’ll fill you in on all the goodies later in this review.

Fun Fact: National General Insurance is the only U.S. insurance company to be launched within the automotive industry.

Financial Stability

Ok, so you’re weighing your insurance options as you read this article. What should you be on the lookout for?

In my opinion, the financial strength of a company is one of the most important factors to consider.

A.M. Best is one of the most trustworthy agencies out there and they gave National General Insurance an A- rating.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Auto Insurance

National General Auto Insurance is a household name because they have been insuring cars for nearly 70 years.

If any company understands the car business, it’s this one.

National General Insurance ALSO provides variations on traditional car insurance:

RV Insurance

This specialized RV insurance covers things that ordinary auto insurance doesn’t. National General Auto Insurance prides itself on flexibility and affordability. They also offer exceptional RV protections such as Optional Full Replacement Cost Coverage.

Small Business Auto Insurance

Whether your salesforce has flatbed trucks, stake body trucks, refrigerated vans or company cars, National General Insurance provides coverage for your commercial vehicles.

Collector/Classic Car Insurance

This specialized coverage protects classic cars, exotics, muscle cars, modern classics, replicas, street rods, lowriders, military vehicles, fire trucks and more.

Buyer Beware: Hagerty insurance is the company that actually issues these policies.

Benefits & Specialized Coverage

National General auto insurance also offers some other car related benefits and specialized coverage options:

National General Insurance Motor Club

National General Motor Club provides some wonderful perks through their motor club:

- 24/7 Roadside assistance at good rates

- Towing without mileage or dollar limits

- Emergency Expense Reimbursement: up to $750

- Benefits for eligible members in any car

- Trip planning benefits including free maps and online trip planning

- Travel, entertainment, dining & retail discounts

National General Insurance: Mexico

If you’re planning on taking a trip to Mexico, this policy will ensure that your auto insurance will still cover you under Mexican law.

It’s so very important to find the right insurer for your car insurance to try and mitigate the damage rising rates will do to your bottom line!

Car insurance prices have been on a rocky road.

Home Insurance

Homeowners coverage from National General provides options for every kind of living situation from house, to condo – they even cover renters. Discounts may apply and different coverage options are available.

Extended Coverage & Scheduled Properties

National General Insurance Homeowners Program gives you the flexibility to purchase extended coverage for high-value property, or to cover homes that are valued at $1 million to $5 million.

Flood Insurance

Flood insurance provided through the National General Insurance Homeowners Program. The good news is even if a federal disaster is not declared you will get paid.

The following types of flood insurance coverage are available:

- Flood Insurance – Covers the value of the structure, minus the land value, up to $250,000.

- Contents Coverage – Optional coverage that must be requested in addition to regular flood coverage. Available for up to $100,000 to cover the contents of your home.

Earthquake Insurance

Do you live in an area that is susceptible to earthquakes? If so, earthquake coverage is essential for your financial protection.

Home Warranty Programs

This insurance provides assistance for routine maintenance issues, and their unexpected expenses.

With a home warranty policy, you pay an insurance premium which allows for maintenance and repair visits to your home for a very nominal fee. If you have an older home this coverage is key.

Additional Coverages include:

- Coverage for Mobile and Manufactured Homes

- Landlord & Dwelling Fire

- Antique and Collector Cars

- Personal Umbrella and Excess Liability (from $1 million to $5 million)

- Scheduled and/or Blanket Valuables (Jewelry, Furs, Fine Arts, Musical Instruments, Computers, Silver)

- Watercraft/Yachts

- Personal Watercraft and ATV

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Small Business and Commercial Property Insurance

Small business have a lot to protect. National General Insurance offers the following coverage to do just that:

- General Liability

- Business Owners

- Professional Liability (E&O)(D&O)

- Workers’ Compensation

- Employment Practices Liability Insurance (EPLI)

- Commercial Umbrella, Commercial Property

- Commercial RV

- Cargo Coverage

- Liquor Liability Insurance.

Health Insurance

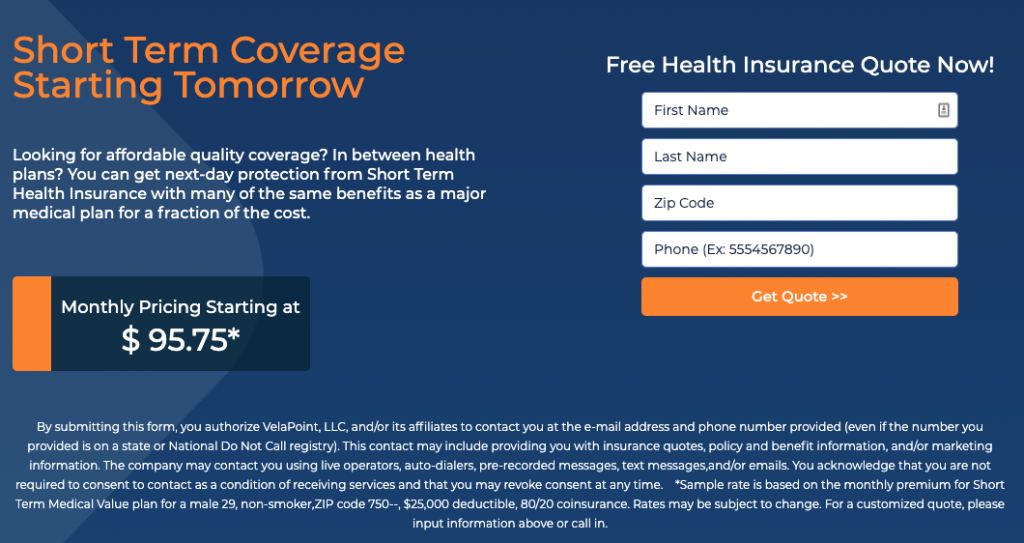

Buyer Beware: National General offers short term health insurance through VelaPoint, not directly through National General.

Dental Insurance

National General Insurance offers the following dental insurance options:

- Dental PPO: Visit network dentists to save an average of 40% on dental care.

- Dental Indemnity Plan: The Dental Indemnity plan pays cash benefits when you have dental checkups and treatments, helping you catch small problems before they become big expenses.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

National General TrioMed Insurance

This plan provides three supplemental insurances in one plan.

There are three benefit levels:

- $2,500

- $5,000

- $10,000

You get coverage for:

- accident-related health care costs with Accident Medical Expense

- Receive lump-sum, cash benefits to help you pay for treatment after a covered, first critical-illness diagnosis

- accidental death and dismemberment benefits

Critical Illness Insurance

National General provides two kinds of coverage:

- Cancer Heart & Stroke

- Critical Illness – Term Life

Hospital Coverage

Deductibles and other out-of-pocket expenses build up. This is especially true if you don’t have money set aside for it. Protect yourself from the cost of lengthy hospital stays with this coverage.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

AcciMed Insurance

AcciMED is a simple solution that helps you pay out-of-pocket costs so that you can receive and afford the treatment you need.

Benefit Levels:

- $2,500

- $5,000

- $7,500

- $15,000

Personal Umbrella Insurance

Umbrella coverage is provided by an affiliated company called NatGen Premier. Protect your family’s assets with a Personal Umbrella Policy. This stand-along protection that provides an extra layer of confidence. No change of insurance carrier is necessary. This program is available in most states.

- Liability limits up to $5 million

- Preferred, Standard, and the new Standard II underwriting tiers for easy risk qualification and rate determination

- Quick and simple application process

- Competitive premiums available for all coverage limits and types of risks

Whew! Now THAT’S a HUGE selection of products.

If you’re looking for choice and coverage to fill in every gap, National General Insurance is the company for you!

Discounts

One of the most exciting selling points for National General Insurance are the discounts and services that may apply to their policies.

The average policyholder will save up to $442 per year, that is, if they qualify for these discounts. As you can see, there are a number of them!

- GM/GMAC Customer Discounts

- Multi-Vehicle Discount

- Safe-Driver Discounts

- OnStar Subscriber Discount

- Affinity Discounts

- Paid in Full Discount

- GM Loyalty Discount

- Motorcycle Discounts

- Low Mileage Discount

- GM Supplier Discount

Buyer Tip: Discounts can save you quite a bit when it comes to insurance premiums. Check it out – United Healthcare has partnered with the Apple Watch Motion program to offer $1K off their premiums annually! True story.

U.S. health insurer UnitedHealthcare is adding the Apple Watch Series 3 to its Motion program, which lets people earn up to $1,000 per year off their insurance premiums —assuming they meet daily fitness goals. UnitedHealthcare adds Apple Watch Series 3 to insurance discount program, Apple Insider

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Smart Services

But that’s NOT all! National General Insurance offers specialized SmartServices.

National General Insurance goes steps beyond traditional insurance. They want you to feel like you’re a part of a club – and they follow through by offering these perks:

- A Lifetime Guarantee

- An Emergency Expense Allowance

- SmartValet

- SmartAssist

- Additional Equipment Coverage

- Storage Option

- SmartInspect

- 24 Hour Claims Reporting

- SmartReplacement

- Convenient Payment Options

- SmartDriver Coverage

- RVs and Autos on One Policy

National General Insurance Rates

Sure, National General Insurance has some unique features… but what’s this gonna’ cost me?

Well, I’ve got some GOOD news and some BAD news!

When compared to their competitors, National General Insurance’s premiums are nearly 10% higher than average. Yep. All that choice and service comes with a price.

But before you take this company out of consideration, don’t forget about the discounts!

It’s All About the Discounts

Check to see if you qualify, and if you do, there’s a good chance you can get a policy at a VERY competitive price.

These discounts really do make a difference. If you’re a:

- low mileage driver

- GM owner

- a “safe driver”

- if you’re looking to insure multiple vehicles

- or, if you can afford to pay your premiums up front

If you meet this criteria, National General might just save you a pretty penny. So, the cost of their policies really hinges on your PERSONAL circumstances.

Quite simply, one of the best ways to pay less for your insurance policy is to compare multiple quotes.

That’s why I always recommend that people speak with an independent agent. They know the ins and outs of the companies you are likely to consider and will find the best fit for you.

Sample Quotes

Not all quote processes are the same. Some companies make it easy and convenient. One, two three – here’s your quote. While others make you want to pull your hair out!

Just get me the dang quote already! So, where does National General Insurance fall on this spectrum?

Well, to start off, you’ll need to give them some basic information.

You can’t get a quote without this input…and don’t get me started on how much I dislike those little asterisks!

To be fair, the more information you provide, the more accurate your quote will be. That being said, I can identify with people who aren’t fans of sharing their personal info on the internet.

In essence, you have to go through a six-step process before you get a quote. The good news is you can find out right away which discounts you qualify for!

Pros and Cons

Pros:

- SmartDiscounts

- SmartServices

- 24/7 claims department

- Flexible payment options

- Awesome selection of products

Cons:

- Expensive

- Negative Reviews – Customer Service & Claims

- Not that easy to get a quote

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Claims

When accidents happen, it’s best to file a claim as quickly as possible to get the ball rolling. This way, you’re more likely to get the financial protection you need.

But who knows when an accident will strike? Thankfully, National General Insurance’s claims department is available 24/7.

Not only are they prepared to handle your claim around the clock, but they also give you a few options for filing.

You can do it the ol’ fashioned way and call, or you can file online.

The company even has an iPhone app!

Flexible Payment Options

Feeling a little cash strapped? Fear not – National General Insurance offers flexible payments to fit your budget. You can pay in full or use an installment plan.

Customer Service Reviews

Like every insurance company, National General has received their fair share of negative reviews. So, what are people fussin’ about?

From what I can see, most of the negative reviews are connected to customer service and claims.

As you can imagine, there’s definitely some overlap between these two areas. If you’ve filed a claim you’ll need support from customer service.

The truth is, customer service is the most common complaint when it comes to insurance companies, and National General Insurance is no exception.

I do want to stress that just about every insurance company has a tough time catering to each and every customer.

That said, there are too many one-star reviews connected to National General Insurance to ignore.

Is National General Insurance For You?

In my humble opinion getting a quote should be as easy as 1, 2, 3. Sadly, National General Insurance process is more like 1, 2, 3, 4, 5, 6!

Face it people have short attention spans- so this quoting process may lose them some business.

If you’re searching for National General Insurance Reviews – bet you’re looking for the Bottom Line!

As with ALL insurers, there are pros and cons. I don’t think I’ve EVER reviewed a company that was perfect!

In fact, you need to be VERY cautious about online reviews period. Agitated customers are FAR more likely to share their experiences than satisfied ones.

This is a sad but true fact of life.

In a nutshell, my heartfelt advice is to get yourself to an independent insurance agent today! They will check out all the options on the market to make sure that National General Insurance is the RIGHT company for you.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.