Online Term Insurance: 10 Tips to Help You Get the Best Deal

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Anyone can get the best deal on life insurance by going online and getting a quote with a simple click of a button. Right?

Wrong!

In this post, I’ll explain how easy it is to make costly mistakes when buying online term insurance, and how you can avoid them.

In addition, I’ll show you how the process of purchasing life insurance online works, and outline the smartest way to buy a policy.

You will save yourself a lot of grief and get the best value for your hard-earned money if you follow our tips.

10 Tips for Buying Online Term Insurance

- #1 Beware Instant Quote Engines

- #2 What is Your Rating – Possibly Not “Preferred Best”

- #3 What Happens to Your Personal Information?

- #4 Multiple Quotes Help You Find the Best Bang for Your Buck

- #5 Not All Instant Quote Engines Are Created Equally

- #6 Financial Planning: How Much Insurance Do You Need and for How Long?

- #7 What’s the Process for Obtaining Life Insurance?

- #8 No Medical Exam Policies Probably Aren’t Right for You

- #9 Captive Agents and Why You Should Avoid Them

- #10 Independent Agents and Why You Should Use Them

Let’s face it… too many Americans believe that life insurance is a confusing, depressing, yet necessary nuisance. Hey all types of life insurance companies are the same after all, right? Nothing could be further from the truth.

Online term insurance quotes are advertised everywhere, which might lead you to believe they are all created equal…but they’re not! That’s why it’s important to consult with an independent life insurance agent.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

We will share the ins and outs of companies that may have very different approaches to your unique circumstances.

Without the help of an independent agent, consumers may be easily misled into buying a policy that:

- Is More Expensive

- Provides the Wrong Type of Term Insurance

- Pairs You with the Wrong Insurance Company

10 Tips to Find Online Term Insurance

Tip 1. Beware of Life Insurance Online Quote Engines

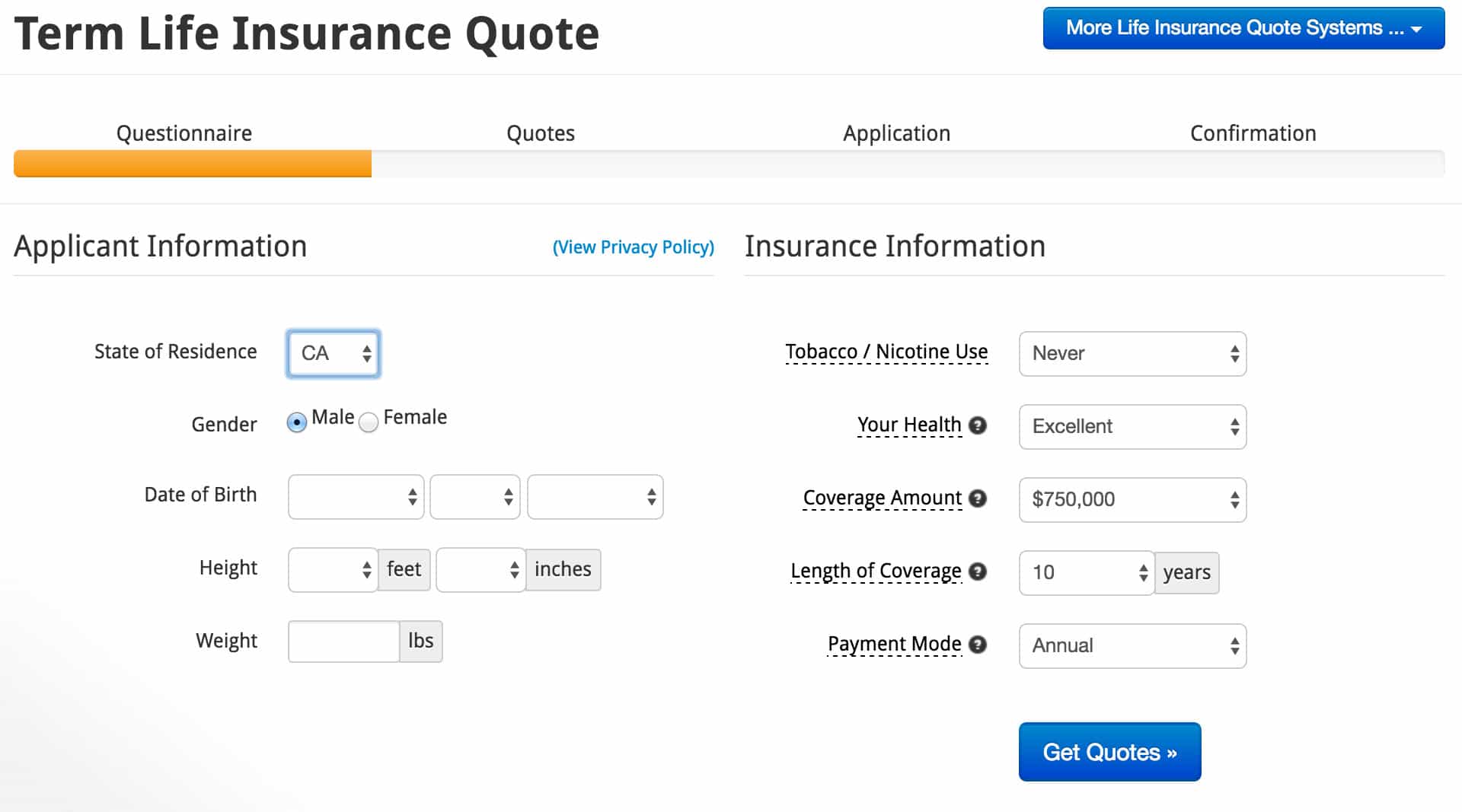

Just about every life insurance company and agent offers an “Instant Quote” engine… ours is found here.

It seems easy enough. All you have to do is add a little personal information, the amount of life insurance you want, the length of term and voila a quote is generated for you.

The rate quoted probably looks fantastic – so it’s very likely you will select the first company that pops up with the lowest figure.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

Unfortunately, it’s not quite as simple as this. Further, into the process, you may receive an updated quote from the company which is more than 3 times the figure provided in the instant quote you received.

What happened? In a nutshell, you did not qualify for the rating they provided:

It’s imperative that you discuss your individual medical history with an independent agent. Life insurance quote engines are a great start, but they are unable to give you the personal attention that will result in the lowest possible rate for your unique circumstances.

In other words, it’s very important to explore all your options and know-how quote engines work before you commit to a policy.

Keep reading…

Tip 2. All Online Life Insurance Quote Engines Generate “Preferred Best Rates”

So, what are “Preferred Best Rates”?

Every life insurance company offers 10 – 15 health rating categories. “Preferred Best” provides the lowest possible rate to consumers.

In reality, only 3% of applicants qualify for this rating.

Most people who apply for life insurance will be assigned some other classification. This includes ratings such as “Preferred”, “Standard” or another classification.

Each change in the rating classification adds an additional 25% to the premium you pay. So, if you think you’re going to pay $100.00 per month based on the “Preferred Best Quote” you received, the actual premium might end up being $150.00 from that particular company.

Incredibly, the 2nd, 3rd or even 5th company which shows up in the quote results might actually be able to provide the same policy for $135.00 because they have less stringent qualifications for your particular circumstances.

How life insurers rate people also varies considerably from company to company. Some carriers are much more lenient than others.

Don’t be fooled by the rate you are quoted when you apply for an instant quote for term insurance online. The actual rate you receive will depend on a variety of factors such as:

Tip 3. Beware of Giving Your Personal Information to Quote Engines

Privacy is one of the biggest problems people encounter when dealing with online term insurance quote engines.

You type in all your personal information including your email address, and all of a sudden you get spammed by a dozen or more agents peddling their services. Unfortunately, these quote forms are often used as a portal for multiple agents.

Who needs the hassle?

Rest assured, Huntley Wealth treats your personal information with the utmost respect. You will not be spammed by agents when you request a free quote on our site. One agent from our company will contact you and that’s the end of the story.

Tip 4. Get Multiple Quotes on Line

You shouldn’t be satisfied with a single quote. Although independent agents use dozens of companies, they don’t have access to every life insurance company. Obtaining multiple quotes enables you to find the best possible rates for your particular circumstances.

I would, however, add, that most independent agents tend to stick with top-rated companies. To clarify, top-rated companies aren’t always the best-known brand names. Just because the carrier is well known, doesn’t mean they offer the cheapest rates.

For life insurance purposes, top-rated companies are those which are known to be financially sound and provide the lowest cost life insurance for your particular health, age and height/weight ratio.

Tip 5. Use a Quote Engine That Enables you to Peruse Different Health Classes

As mentioned above, many quote engines provide you with figures based on Preferred Best Rating. If you already know you have health issues, it makes sense to use a site that enables you to switch your health class.

This will give you a more realistic quote from life insurers because you provide them with more information to evaluate your overall health.

After an underwriter reviews an application and medical results, many are shocked by the final quote they receive, which may cost as much as 50% more than anticipated!

Tip 6. What You Need to Buy Online Term Insurance

When purchasing online term insurance, there are 2 major considerations you should nail down before you go quote hunting including:

- The amount of life insurance needed

- The length of time you want the life insurance policy in place

If you are using life insurance as “income replacement”, most experts suggest that you should obtain approximately 10 times your annual salary to safely cover your family.

Other considerations you need to address are:

- An Outstanding Mortgage

- Personal Debts

- Funeral/Burial Expenses

- Cost of College Tuition for Kids

- Potential Business Purposes

The next step is to choose the length of Term that you want in place such as 10, 15, 20, 25 or 30 years. This is a very important aspect of your decision.

Dave Ramsey, a leading financial consultant, says:

You might be trying to save a few dollars by choosing shorter term coverage. But what happens if you buy a ten-year policy and you have medical issues ten years from now that raise the cost of your next plan—or worse, make it so you can’t get coverage at all? That will cost you even more in the long run.

If you buy a policy for 30 years and find that you no longer have a need for it after 22 or 25 years – you can always cancel it. Just keep in mind that life insurance becomes increasingly more expensive as your age, especially after 35.

Think long term when it comes to your financial projections. You can always supplement your life insurance with an additional policy later on for a smaller amount of money and a shorter term.

Tip 7. The Online Term Life Insurance Process

A standard term policy cannot be purchased completely online, without eventually deciding on an agent and following the standard process.

As David Weliver at moneyunder30.com points out:

You can’t really buy life insurance entirely online. The process can involve a ton of questions, paperwork, and a medical exam. .., but you still have to buy insurance from an insurance company, most of whom are still living in the pre-digital era. Technology has also not yet advanced to the point where a company can know enough about your health to forgo a medical exam…

The steps are pretty easy to follow so you shouldn’t feel intimidated. Let me explain how it works so you know what to expect.

Life Insurance Process:

- After you get your quotes, you will have to contact an agent. It’s better to speak with one on the phone. Prepare your questions beforehand so you won’t be tempted to make any premature commitments.

- The agent will ask you a number of questions. It is important to provide any and all information truthfully.

- Once you have selected an insurance company, you will complete the application which is usually done over the phone.

- The insurance company will set up an appointment for a medical exam. Don’t be daunted by this. It’s a basic blood test, so the procedure fairly non-invasive.

- The insurance company underwriter will review all your information and will provide a quote which the company or agent will present.

- If you agree with the quote, you will then receive a policy, which you will have to manually sign or e-sign.

In most instances, your application will be processed in 2 – 3 weeks. In some situations, it might take longer if the insurer opts to contact your physician or hospital for additional information.

NOTE: If you are uncomfortable with your policy after signing on, you have up to 2 weeks to cancel without penalty.

Lifehappens.com also has another invaluable tip to keep in mind:

Check for complaints against a company. Life insurance companies are regulated by state departments of insurance, which track complaints filed by consumers. Though the type and quality of complaint information will vary from state to state, it is another measure you may want to consider when choosing a company. To look up complaints against a particular company, visit the National Association of Insurance Commissioners’ searchable database

Tip 8. Don’t Buy “No Medical Exam” Policies From Your Employer If You Are Healthy

Many life insurers offer no medical exam life insurance. All you have to do is answer a few questions and you receive approval in 1 – 2 days.

What these sites don’t tell you is that these policies, on average, cost 3 times what you would pay for the same policy with a medical exam.

Do the math!

Say you bought a 20 year term no-medical exam policy for $60 per month. You could obtain the same policy by taking a medical exam for $20 per month, the difference in the cost is:

N0-Medical Exam Policy = $60 x 12 months x 20 Years = $14,400.00

Medical Exam Policy = $20.00 x 12 months x 20 Years = $4,480.00

That’s a difference of OVER $10,000.00!

If you are young and relatively healthy, you should always get an online term insurance policy which requires a medical exam.

Even if you have some health issues, don’t assume you can’t get better rates. Always consult an independent agency to make sure you get the best possible rates for your unique circumstances.

Tip 9. Don’t Buy Life Insurance From Captive or Pushy Agents

What is a Captive Agent?

Well, some insurance companies only use agents which represent their offerings. Examples of life insurance companies that use captive agents include State Farm, Farmers, Allstate, and Geico.

Captive agents only give you quotes from the company they represent. Which means you have no options in regard to finding a lower rate…or you may be declined altogether. Just because one company declines your application doesn’t mean you can’t obtain approval from another.

In other words, captive agents can’t get you insured with another company.

What do I mean by pushy agents?

Many agents these days are pushing whole life and/or will try you to persuade you to buy an insurance rider(additional coverage).

Most Americans do not require whole life. It should only be used in very specific situations, such as if you have an estate or a business for example.

The majority of financial and life insurance experts suggest that most people are best served when they buy a term policy and invest the difference.

The same applies to life insurance riders. They can cost a lot and most people simply don’t need them.

As thesimpledollar.com points out:

If your bottom-line goal is to find the cheapest insurance possible, you’ll want to say no to any add-on insurance or policy riders. Examples of add-ons include the option to purchase child policies or more insurance at a future date without going through the medical exam process again.

You can think of riders as à-la-carte options to supe up your policy. Riders can be purchased to accelerate your death benefit and pay you out for medical expenses if you have a terminal illness but haven’t passed away yet. Term conversion is another rider that gives you the option to convert your term policy to a permanent (whole life) policy.

Bottom Line: If your agent tries to push Whole Life or Insurance riders – RUN!

Tip 10. Why Independent Agents Are Your Best Bet

In conclusion, a good independent agent works for you and not the life insurance company. They evaluate your individual financial needs, health concerns and provide you with a variety of options.

They can show you a number of strategies to reduce your cost while obtaining the protection you need.

Additionally, independent agents represent dozens of companies.

We can help you find the right policy at the best possible rate. We don’t just sell a policy and leave; we form long term relationships. Life insurance needs change over time and we can help make adjustments when the time comes.

Buying online term insurance is not as straightforward as it seems, but we make the process as easy and painless as possible.

Call us today at 888-603-2876 if you need online term insurance. We can help!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.