SBLI (Savings Bank Life Insurance) Review

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Before you decide to sign on the dotted line with SBLI, I recommend that you do some serious research!

This is a vital step since life insurance is a long term investment.

Are you really getting the best policy and at the most affordable rates? Are there better alternatives out there?

Let’s see how SBLI stacks up to the competition now!

- About SBLI

- Financial Ratings for SBLI

- SBLI Term Life Insurance

- SBLI Whole Life Insurance

- SBLI Annuities

- Underwriting

- Sample Quotes

About SBLI (Savings Bank Life Insurance)

Every life insurance company begins somewhere. Let’s take a look at their story.

The origins of this esteemed company stretch back in time to 1907. The company was founded by Louis Brandeis who would become a Supreme Court Chief Justice.

When he began the company his vision was to create a savings bank to provide families with a more affordable alternative for life insurance. He did so because he was of the belief the industry was in a state of disrepute.

The company grew and prospered through the decades to become one of America’s leading life insurers. The goal of the company remains the same. Its corporate mission is to provide dependable and affordable life insurance to all those who require it.

The headquarters of the company is based in Woburn, MA and sells its products in every state with the exception of N.Y. SBLI now has 1,000,000 plus customers in its corporate fold. SBLI is very active in the non-profit community.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

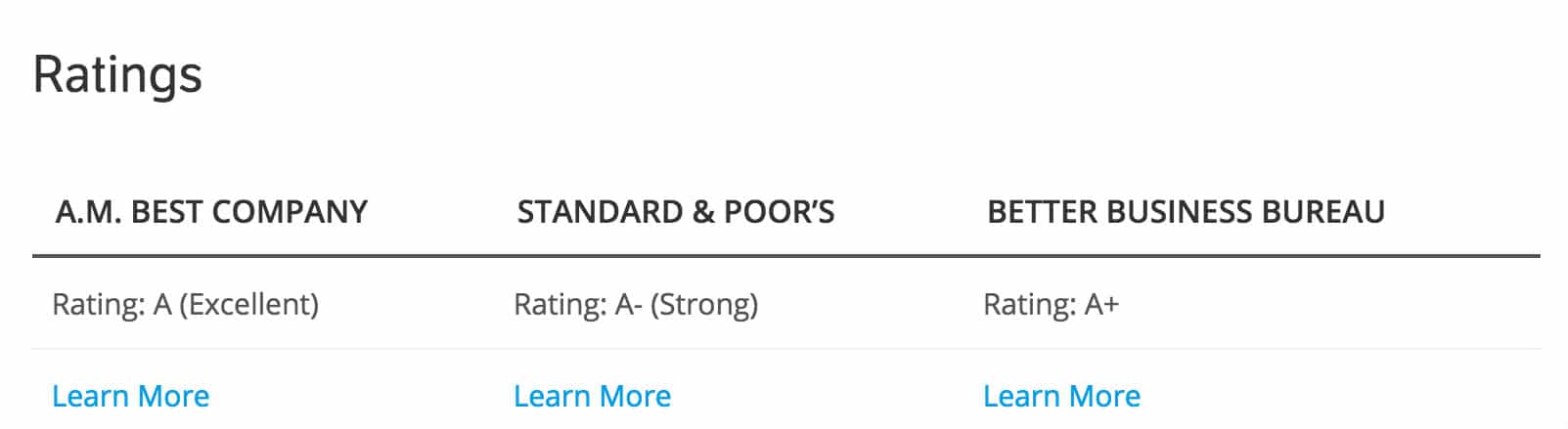

SBLI Financial Ratings

Our life insurance reviews always reveal one crucial piece of research, the financial ratings of the insurer in question. Saving Bank Life Insurance is no different.

Being aware of the financial strength and stability is something that every person who intends to purchase life insurance should know before they buy their policy. To make such a long term investment with any company, you need to feel confident in the stability of their business.

Is the company you are considering fiscally responsible in how it invests and earns on its profits? This is an important piece of the puzzle.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

A solid life insurance company will be able to honor its claims decades down the road. When your loved ones need to make a claim, they will not encounter any surprises.

Financial rating companies rate each and every life insurance company, publishing their reports annually.

So, let’s see how well SBLI performs. This will help you decide if this is a company you are confident investing your hard earned income with:

Well, from these results, our Savings Bank Life Insurance review clearly indicates that this company is on a solid financial footing. Although, AM best downgraded them from an A+ to an AA- in November 2016, so you may want to keep an eye on that.

At this point in time, I would give this company a reasonably strong thumbs up based on their current financial strength.

FIND OUT IN 2 MINUTES IF WE CAN BEAT SBLI’s RATE

We treat every customer like their family. Our agents have NO sales quotas, so we’re able to spend all the time necessary with every client…. there’s no hurrying off to the next call with our agents.

SBLI Life Insurance Products

Every life insurer has a unique blend of life insurance products. The types of policies which you can buy from SBLI include:

- Term

- Whole Life

- Universal (Only available when you convert a term policy to a permanent policy)

- Annuities

Let’s use our Savings Bank Life Insurance review to break down the policies offered in more detail.

SBLI Term Insurance

Term life insurance is by far the most basic and affordable form of life insurance available. You buy it for periods of time or a term and all you have to decide on is how much you need. The company offers 3 types of term life insurance including:

• Guaranteed Level Premium Term – This policy is available for terms of 10, 15, 20, 25 and 30 years. The premium is guaranteed for the life of the term. These policies also include a conversion feature which allows you to convert the policy to a universal permanent policy (universal policies are not available separately). Policies are available for those ages 18 – 80 and offer face amounts of coverage from $100,000 – $500,000.

• Yearly Renewable Term Insurance – Known as YRT is a term policy which automatically renews annually. You may have to take a medical exam when you initially apply for this term policy, but you won’t have to do this for each renewal period. You simply pay based on your age at the time of renewal. This policy also allows you to convert to a permanent policy without a medical exam.

• One Year Non-Renewable Term – Provides coverage for 1 year with a single premium (not renewable after expiry). Also allows you to convert to a permanent policy without a medical exam.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

SBLI Whole Life Insurance

Whole life insurance protects your family for the duration of your life. The premium is set and will never increase. This however means that you will be paying quite a bit more for your coverage than you would with Term insurance. We recommend purchasing term life insurance for most of our clients as it suits most people’s needs.

There is also a cash value component that grows tax-deferred that you could use to pay expenses such as college tuition and retirement income.

What is Cash-value Life Insurance?

Cash-value life insurance is a type of life insurance policy that pays out upon the policyholder’s death, and also accumulates value during the policyholder’s lifetime. Cash Value Life Insurance, Investopedia

SBLI allows you to borrow from the policy’s cash value after only one year.

Another unique feature is that SBLI whole life policies are eligible to receive annual dividends. You can leave the money to accumulate interest, it can be used to reduce future premiums, fund paid-up policy additions, or be taken as cash. While dividends are not guaranteed, SBLI has a solid history of distributing them.

In a volatile world, SBLI whole life insurance policies are guaranteed which means they will retain their value regardless of economic conditions.

Outline of SBLI Whole Life Policy Offerings:

- Borrow from the policy’s cash value for any reason after only one year.

- Guaranteed, tax-deferred cash value growth, regardless of economic conditions

- A guaranteed, income tax-free death benefit

- Potential additional cash value growth from dividends

- Policy add-ons known as riders to satisfy unique financial needs

- No policy funding limits based on income

SBLI Annuities

If you are not clear on what is meant by an annuity, the concept is actually quite simple. It is a contract between you and the insurer where you decide on a payment option to the insurer who in turn invests the money.

At the conclusion, you then receive annual payments which can be used to supplement your retirement income.

When you buy an annuity you’re relying on the insurance company to make payments for decades. Going with an insurance company that is large, well-established, and well-capitalized helps. Annuities: Your DIY Pension Plan

SBLI has 2 types of annuities:

• SBLI Single Premium Immediate Annuity – where you pay a single premium upfront. You can start receiving payments monthly, quarterly semi-annually or annually.

• SBLI Optimizer MVA Series Annuity – is a fixed deferred annuity option. You decide on the date you want to start receiving payouts. This annuity features penalty-free withdrawals and fund access during critical life events such as terminal illness.

SBLI has some unique products which are not available through other life insurers. One limiting aspect of their offerings is that permanent policies are restricted to whole life.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Comparing SBLI Underwriting and Ratings to Competitors

Every life insurance company has its own distinct and unique guidelines in how they underwrite a policy.

Some companies specialize in certain niches for health issues. Others may be more lenient when it comes to a person’s family history, smoking habits or driving history.

I am going to cover the 5 underwriting criteria life insurance companies use and compare them to 2 other randomly selected companies, VOYA Life Insurance and Principal life insurance.

SBLI Health Ratings

These standards are for a “Preferred Plus” Term life insurance policy:

Height/Weight Ratio for 5’10” Person

- Unisex chart for both genders – maximum weight – 196 pounds

Tobacco Use

- No tobacco for 5 Years *Occasional cigar use can be considered non-nicotine if you smoke 12 or less per year and fully admit to it on the application. Current nicotine test has to be negative.

Maximum Blood Pressure

- Treated or Untreated: 135/85 up to age 60 140/85 age 61 and over

Maximum Cholesterol Treated

- 120 minimum 300 maximum Treated or Untreated CHL/HDL Max 5.0 for males Max 4.5 for females

Family History Requirements

- No cardiovascular problems in parents or siblings prior to age 60

- Waived if insured is 65 or older and meets all other preferred plus criteria

- Family history is disregarded if aged 70 years and older

- No familial breast, ovarian, prostate, melanoma, thyroid, lymphoma, or colon cancer

Comparing SBLI to VOYA Life Insurance Health Ratings

Height / Weight Ratio

- Ages 16 -60: A male or female who is 5’ 10″ tall can weigh between 129 – 208 pounds.

- Ages 61 Plus: A male or female who is 5’10″ tall can weigh between 129 – 222 pounds

Tobacco Use

- No tobacco or nicotine use for 5 years.

Blood Pressure

- Ages 16-60: No current or prior blood pressure reading in excess of: Male: 135/90 – Female: 135/85.

- No history of treatment for hypertension.

- Ages 61+: Average of past 2 years blood pressure readings not in excess of 140/95 plus no pulse pressure greater than 70.

Cholesterol HDL Ratio

- Ages 16-60: (Treated or untreated) Cholesterol Max 300.

- Maximum HDL Ratio Male 5.0 / Female 4.5. Ages 61+: (Treated or untreated)

- Cholesterol Max 300.

- Maximum HDL Ratio Male 6.0 / Female 5.5.

- Minimum Serum Albumin Male 4.0 / Female 3.9

Family History

- Ages 16-60: No cardiovascular deaths in parents prior to age 65.

Comparing SBLI to Principal Life Insurance Health Ratings

Height/Weight Ratio for 5’10” Person

- Ages 18 – 44: 122 – 202 pounds

- Ages 45 – 60: 122 – 206 pounds

Tobacco Use

- No tobacco use for 2 years ages 20 – 70; no tobacco use for 3 years ages 71 – 85.

- The exception is 12 or fewer cigars per year with negative urine.

Blood Pressure

- Cannot exceed 140/85 for ages 20 -44

- Cannot exceed 140/90 for ages 45 – 64

- Cannot exceed 145/90 for ages 65 -85

Cholesterol

- Ages 20 – 64: total cholesterol cannot exceed 270 or cholesterol/HDL of 5.5

- Ages 65 – 85: total cholesterol cannot exceed 280 or cholesterol/HDL of 6.0

Family History

- Must be no death of family member prior to age 60 due to:

- Breast cancer

- Colon cancer

- Ovarian cancer

- Prostate cancer

- Diabetes

- Family is not considered for applicants over age 71.

We have found that SBLI is a favorable life insurance company if you are in good health. However, SBLI may be a bit more restrictive when it comes to variety of health issues when compared to other insurers.

Comparing SBLI’s Premium Cost to Competitors

So how do SBLI premiums stack up to the competition?

We are going to compare them to Voya Life and Principal Life, using Term4Sale.com.

Let’s check out the annual and monthly premiums for a 20 Year Term for men and women who qualify for “Preferred Plus” quotes with $250,000 in coverage.

SBLI Sample Quotes

- 30 Year Old Female: $13.31 monthly, $153.00 annually

- 35 Year Old Female: $13.99 monthly, $160.80 annually

- 40 Year Old Female: $18.99 monthly, $218.25 annually

- 30 Year Old Male: $14.79 monthly, $170.00 annually

- 35 Year Old Male: $16.29 monthly, $187.25 annually

- 40 Year Old Male: $21.67 monthly, $249.03 annually

VOYA Insurance Sample Quotes

- 30 Year Old Female: $13.78 monthly, $157.50 annually

- 35 Year Old Female: $15.53 monthly, $177.50 annually

- 40 Year Old Female: $19.91 monthly, $227.50 annually

- 30 Year Old Male: $14.66 monthly, $167.50 annually

- 35 Year Old Male: $16.41 monthly, $187.50 annually

- 40 Year Old Male: $21.44 monthly, $245.00 annually

Principal Insurance Sample Quotes

- 30 Year Old Female: $13.30 monthly, $152.00 annually

- 35 Year Old Female: $13.69 monthly, $156.50 annually

- 40 Year Old Female: $17.06 monthly, $195.00 annually

- 30 Year Old Male: $14.66 monthly, $167.50 annually

- 35 Year Old Male: $14.66 monthly, $167.50 annually

- 40 Year Old Male: $19.25 monthly, $220.00 annually

SBLI Review Summary

Here’s a recap of things you should consider before signing on the dotted line with SBLI:

• Availability of Products – SBLI offers basic level term life insurance with a variety of available terms. The company does have some very convenient annual and annually renewable term products not offered by other companies. Permanent policies are available but limited to whole life of which we are not a big fan.

• Underwriting Criteria – Their underwriting criteria for term insurance tends to favor healthy individuals. They are relatively competitive for occasional cigar smokers and for cholesterol levels. Not so lenient when it comes to the height/weight ratio.

• Premiums – I would say that SBLI premium prices are competitive but not the most affordable when it comes to cost.

Overall, SBLI is a solid company.

Which companies do we think rate in the top 10? Please read this article to find out: “The Top Life Insurance Companies“

We Can Help You Find the Best Policy

Huntley Wealth and Insurance Services will pinpoint the life insurance solution that fits your unique situation.

For short term business needs, key man policies, buy-sell agreements, personal term, permanent or no-exam policies our well seasoned agents will walk you through your options.

We are an independent life insurance agency that offers policies from over 50 of the best life insurance companies in America.

The result? We are able to find you the most affordable term policies in the industry.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.