5 Critical Tips Before You Buy Life Insurance

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Mar 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Look:

Buying life insurance isn’t like buying a shirt or a computer.

You’ll likely own your policy and be paying on it for 1o to 30 years (or more), so don’t rush in without reading these critical tips.

I’ve been an agent for a long time. These are the tips I’d give my own mother.

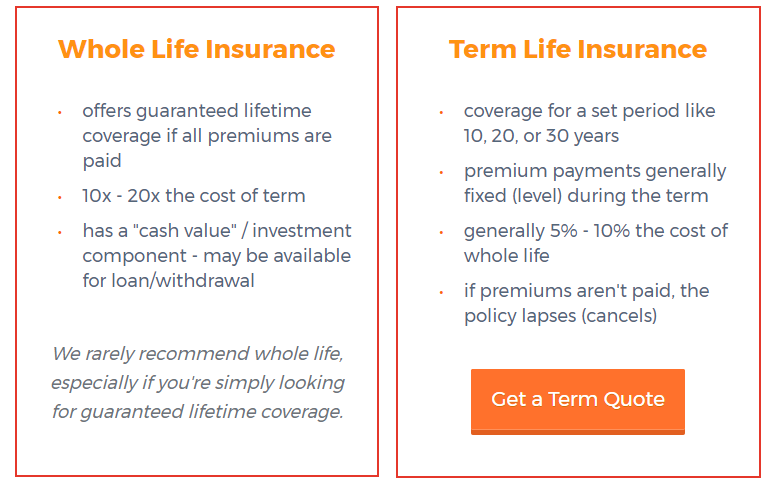

#1 – Stick With Term (Almost) Every Time

Term life insurance is the right choice for most people.

It offers low-cost protection for a set period like 10, 20, or 30 years.

You can use term life insurance to:

- replace your income to your family if you pass

- pay off debts like a mortgage or credit card debt

- get coverage on a non-working spouse

… and more!

Read more: Life Insurance Questions

When you hear the radio commercials announcing you can get $500,000 of coverage for $24 per month, they’re quoting you on term life insurance.

My recommendation?

For the absolute lowest price anywhere, get a quote from AIG Direct. (Best rates typically require a medical exam)

If you want to skip the exam, get a quote from Bestow.

What about Whole Life Insurance?

Very few people need coverage for their entire lives (It’s typically only needed for estate planning) and permanent plans cost 10 to 20x as much. So stick with term!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

#2 – Use An “Independent Agency” for ANY Special Circumstances

Some companies have an ideal clientele and you may not be their ideal client.

For example, say you smoke marijuana or smoke cigars or a pipe…

Most companies will charge you smoker rates (costs 2-3x as much as non-smoker rates).

But not all…

That’s where you need an independent agency. They have access to multiple companies and a good agency will place you with the right company and save you a ton of money!

You need to talk to an independent agency IF:

- You are EXTREMELY healthy – As in, you can run a sub-8-minute mile and have zero health concerns

- You have medical conditions – Anything from asthma, to diabetes, to heart health history, to obesity, to high blood pressure or cholesterol and so on.

- You are over 70 years old

- You smoke marijuana or any form of tobacco

- You have a history of family disease such as cancer or heart disease in either parent or sibling

- You travel or work outside the U.S.

- You participate in dangerous activities such as scuba diving, racing, hang gliding, parachuting, mountaineering, etc.

Read more: Life Insurance with Heart Disease

If any of these apply to you, you need to be VERY careful what company you buy life insurance from.

You could overpay by 25% to 50% easily if you don’t use an independent agency.

The best independent agencies:

One of our favorite independent agencies is AIG Direct. Click here to get a guote from AIG Direct.

If you’re in excellent health (you eat great or maybe you do yoga or run or cycle), then Health IQ is the specialty company for you. They have special rate life insurance for the health concious.

Read more: Health IQ Life Insurance Review

#3 – Taking a Medical Exam Can Actually HURT You

Most agents will tell you the best way to get the lowest price is to take a medical exam.

Think about it…

If the company has your blood and urine, they know quite a bit about your health. It makes you less risky so they can charge you less.

The problem?

What if you think you’re healthy but something is going on “behind the curtains?”

That’s what happened to me the first time I bought life insurance. I had super-high cholesterol (even though I was 27 and felt great). I took an exam and ended up paying 50% more because I took the exam.

Taking a medical exam could have the same negative impact on you.

The solution?

Get some “no exam” coverage in place first.

As long as you’re healthy to the best of your knowledge, you can typically qualify!

It costs a bit more (usually 10% to 20% more) but it’s super quick and convenient. You can buy it online from Bestow in minutes.

Once you get it in place, there’s nothing stopping you from trying to then replace it with a lower cost policy that requires an exam.

My advice?

Unless you have some of the special circumstances I mentioned in #2 above, get a policy from Bestow before you attempt to get a “low-cost” policy that requires an exam.

#4 – It Pays to Shop A Bit

Here’s the way I look at it:

You could be paying on your life insurance for 30 years or more. A monthly difference of just 5% could save you hundreds or even thousands of dollars over the life of the policy!

The solution is simple…

Get more than one quote!

Here are our top 3 companies:

- AIG Direct – Best for the absolute lowest rates or with health conditions

- Bestow – Best for no-exam plans up to age 55

- Health IQ – Best for the health concious

I’ve been an agent for over 15 years now. Over that time, I’ve worked with (and reviewed) a LOT of companies. Believe me… you’ll be in great hands with any of the three above.

#5 – Don’t Sleep on Life Insurance “Riders”

A rider is an additional policy feature you typically have to pay a bit extra for.

In the post-Covid world, some of these are hugely important.

A few of my favorites:

Guaranteed Insurability Rider – Some plans allow the owner to purchase additional coverage without the need to demonstrate insurability. In other words, no medical underwriting is required. For example, during Covid, people who were sick could add some coverage even if they had the virus! (For more information, read our “What is a Guaranteed Insurability Rider?“).

Waiver of Premium – Many people are paying for a waiver of premium rider without even realizing it. If they become disabled or very sick, they can exercise this rider and put a pause on their premium payments. In the event of a lifelong disability, they may never have to pay another life insurance premium. (For more information, read our “What is a disability waiver of premium benefit rider?“).

Child Rider – If you have children, you can typically add coverage on them for up to $10,000 (some companies go higher) without them needing a medical exam. It’s really inexpensive and most of the companies who offer it charge the same amount regardless of how many children you have. So if you have 10 kids, you’ll pay the same as your fruitfully challenged neighbor who only has one!

Accelerated Death Benefits for Chronic or Terminal Illness – many companies allow you to take out a portion of your life insurance death benefit while you’re still living (aka, “accelerate” the death benefit) if you have a chronic illness or are confined to nursing home, or require at-home care.

I highly recommend searching for policies with these features.

When you shop online and just buy the first thing you see, a lot of those companies don’t offer these.

My opinion:

It’s worth getting a quote from an agency like AIG Direct so you can speak to an agent about placing you with a company who may have some of the riders above.

Good luck!

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.