[WARNING] AARP Life Insurance Review: More Cons, Less Pros

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

UPDATED: Dec 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

What’s New In 2021 For AARP Life Insurance

The last year has affected many businesses and operations, including AARP Life Insurance. Keep reading to learn more about what’s changed for AARP since the previous year.

How Has Covid-19 Affected AARP Life Insurance?

The pandemic did not affect AARP’s operations but enabled the company to help its members further. As one of the top life insurance companies for those over the age of 50, AARP has dedicated itself to providing regular updates on the coronavirus. It has also been fighting for members to get vaccines and help get stimulus checks delivered fast.

The life insurance company fought for Americans living on Social Security to receive $1,200 stimulus checks. The company also fought to pass over 175 executive orders and regulations to protect nursing home staff and residents during the pandemic.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

New Products Or Changes

AARP has partnered with various companies to offer new benefits to members this year. Policyholders already have access to many excellent services, and these different partnerships add to the growing list.

Members can now save 15% on NortonLifeLock to help remotely with a computer, laptop, mobile device, and other IT issues. Barclays also announced a new credit card for AARP members.

AARP Life Insurance In The News

In January 2021, two policyholders accused AARP and UnitedHealth Group of charging for costs incurred from illegal insurance commissions. The companies argue the charges are actually for branding and marketing Medicare. According to Bloomberg, similar cases against other insurance companies did not go anywhere.

In February, AARP announced a partnership with Senior Planet and Older Adults Technology Services. They aim to teach tech courses to adults for free. AARP members can go to the company’s Virtual Community Center to find all the free courses.

2021 Latest AARP Life Insurance Reviews

Recent AARP Life Insurance reviews tout the company as reliable and trustworthy. Many reviewers praised the company for these reasons:

Reasonable Prices

On Consumer Affairs, several individuals wrote that AARP has the lowest premiums and most reasonable pricing, especially for those over 50. But there have been a few complications with billing, particularly when trying to change policies.

Honoring Lapsed Policies After Death

AARP has proven to be an honest and moral company, especially when honoring missed payments after a policyholder dies. Relatives of deceased AARP members took to Consumer Affairs to praise AARP. They were swift in waiving missed fees and honoring policies.

Catering to Cancer Patients

In early April 2021, VeryWellHealth named AARP Life Insurance as one of the best policies for cancer patients. Since AARP doesn’t decline coverage for pre-existing conditions (like cancer), the company makes it easy to manage your life plan.

AARP also works with you to offer accelerated benefits and get you your claim fast. While it’s a great benefit, AARP’s policies are only available to Americans over 50 years of age.

If you’re a member of the AARP also known as the American Association of Retired Persons, then you are eligible for the AARP life insurance program.

They specialize in products like health insurance, auto and life insurance, and advice for people in their later years, so it makes sense that you might think that AARP has some of the best life insurance rates around. RIGHT?

Nope! And I’m gonna fill you in on why they’re probably NOT the insurer for you.

Table of Contents

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

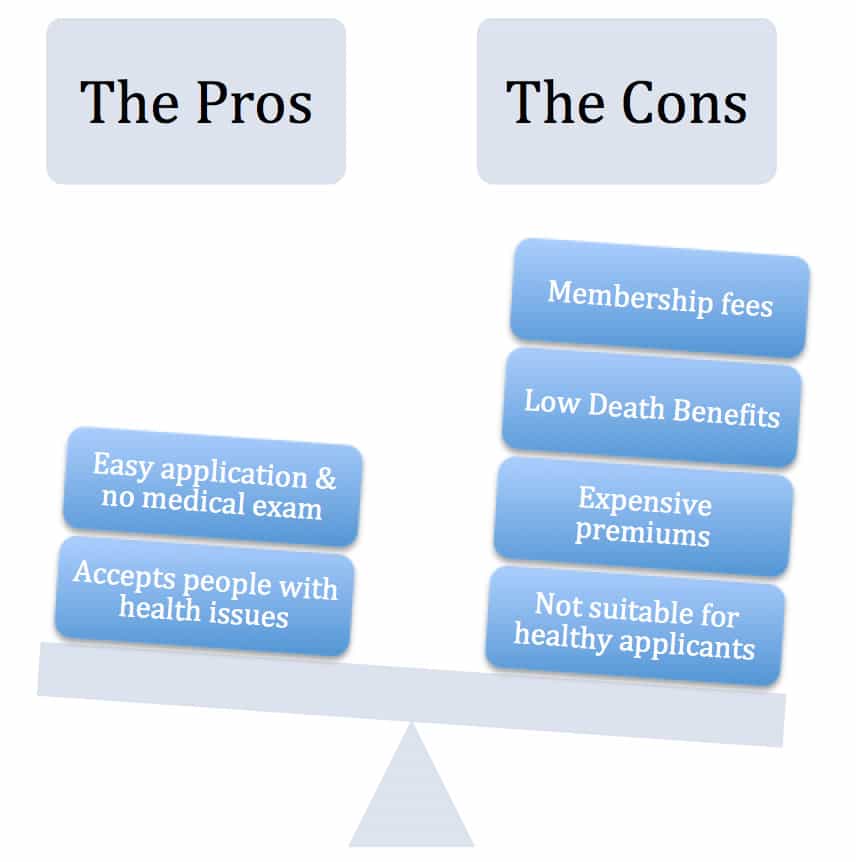

The Pros and Cons of AARP Life Insurance Program

OF COURSE, AARP is a great organization. There’s no doubt about it.

…BUT there are better places to get your life insurance policies if you’re reasonably healthy.

Don’t get me wrong, as a life insurance provider, AARP does have several life insurance plans with a few strong points! Let’s take a look at them now:

- coverage amounts up to 100K in without a medical exam,

- coverage for individuals 50 – 80,

- no criminal record review,

- they cover people with disabilities or other health conditions

- AARP offers a simplified application process for policyholders

- they provide coverage life policies New York Life, one of the best insurers in the market

- if you smoke, you won’t be penalized (that is if you don’t have COPD or emphysema)

AARP Pros and Cons

Pros

No Exam Required, Fast Approval & Convenient: AARP life insurance program is convenient for its members. The products are easy to apply for and don’t require a medical exam. All you have to do is answer a few medical questions (which may be a lot more complicated than you think). This means these products may be most advantageous for those who are not in the best of health and are likely to be declined by other insurers.

NOT SO FAST: Sounds GREAT right? You’re sick or worried that you might be and are afraid you won’t qualify for life insurance – so this is the opportunity you’ve been waiting for.

Hold yer horses. You may still be declined.

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

Yep! It’s true. They have access to medical and prescription databases. You can run but you can’t hide.

Products for Seniors: AARP offers face amounts from $10,000 – $100,000 to clients who are 50 – 74!

NOT SO FAST: AARP term life insurance has more EXPENSIVE premium payments. Chances are you can find you a better deal with another life insurance provider. There are also insurers that will offer you term life policies until age 85 and will provide you with MORE coverage. This is especially interesting to those of you who need insurance for estate tax reasons.

Cons

No Competitive Quotes: The AARP Life Insurance Program offers only 1 insurer – New York Life. You will pay their rates without having considered competitive quotes. Insurance Blogs By Chris, has access to dozens of companies, so you get the best rates available.

Membership Fee: On top of the life insurance premium you pay, you also have to join AARP to qualify for their insurance products, meaning you pay an additional membership fee.

Low Death Benefit Amounts: The ceiling on coverage is comparably lower than what you will find through other life insurers. If you need more than a $100,000 cash value in life insurance – you’re out of luck. Don’t find yourself underinsured.

Expensive Premiums: Because AARP’s life insurance products don’t require a medical exam, you automatically pay a much higher premium. Typically, no exam life insurance costs as much as 3 X what you would pay for a policy which requires an exam.

Not Suitable for Healthy Individuals: If you are age 50 plus and in relatively good health, you would be better off finding a policy that does require a medical exam. The premiums you’ll be offered will be a LOT less than those you’ll pay through AARP.

The policy Terms Are More Limited: AARP only offers term insurance up to age 80 while most other life insurers offer term policies to age 85.

Rising Premiums: YEP. Unlike other insurers that offer guaranteed level term, your premiums will increase every 5 years with AARP. Not only will you pay more, but this cost will escalate if you are a senior.

RELATED: Check Sample Life Insurance Rates by Age (No Personal Info Required)

AARP New York Life Insurance Ratings

No AARP life insurance review would be complete without discussing their ratings and the cozy New York Life AARP relationship.

Here’s the deal, AARP does not actually offer life insurance. NYlife AARP are in a partnership where they send seniors to New York Life insurance who then gives AARP a cut of the sale.

Essentially, they are just the middleman for your life insurance, by going direct you can usually save a ton of money.

If you’re looking to purchase life insurance, you need to work from the foundation up, when it comes to research.

This is one of the most important steps!

The fact is, if your life insurance company is built on a shaky financial foundation, then they may not be able to pay out your beneficiary when the time comes. It’s just common sense to check them out before you make such a large investment in protecting your family.

Hey, who the heck wants to worry that their beneficiaries won’t get paid out when the time comes?

The good news is, New York Life Insurance is a VERY safe bet.

They’ve been around since 1845 and are the largest mutual life insurance company in the US and one of the biggest life insurers in the world!

There is a good reason why AARP New York Life Insurance have teamed up, they are safe company to refer their clients too for that NYlife AARP combination.

Check out their ratings! They’re stellar.

- A.M. Best: A++

- Fitch: AAA

- Moody’s: Aaa

- Standard & Poor’s: AA+

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Life Insurance AARP Products

Beware! Not just anyone can purchase AARP policies. To be eligible for their products you have to be a member!

AARP offers the following products:

- AARP Term Life Insurance Policy: These policies do have the option to convert your term policy into an AARP permanent life insurance policy.

- AARP Whole Life Insurance Policy

- AARP Guaranteed Acceptance Life Insurance Policy: Life Insurance for people from 50 up to 74 years of age.

- AARP Young Start: A unique young start policy for those who have young children or grandchildren.

Once you turn 80 the party is over. No more insurance for you!

Despite the fact I’m writing an AARP Life Insurance Review, they aren’t actually an insurer.

…and no that’s not a typo. New York Life provides the coverage, which is endorsed by AARP.

Their policies are especially interesting to Seniors people because they:

- Don’t require a medical exam,

- Ask only 3 questions

- Don’t make you wait for coverage

Sounds pretty compelling – ESPECIALLY if you have a medical condition.

BUT I’m here to tell you:

“No Exam life insurance appears to be a better gig than it actually is, if you are looking for the lowest rates, No Exam is NOT the path for you”

AARP Term Life Insurance

Provides up to $100,000 of valuable group term life insurance, exclusively for AARP members from the New York Life AARP relationship. There’s no medical exam. Your acceptance is based on your answers to a few health questions and other information we collect.

The AARP Level Benefit Term Life Insurance option is extremely expensive. Essentially, your death benefit or cash value stays the same while your premium rates increase. Again keep in mind AARP’s term life insurance rates tend to be higher than other companies. It is worth it to do your due diligence.

It’s a simple way to provide your family with resources to help:

- Make mortgage or loan payment

- Cover your family’s everyday bills

- Pay medical or final expenses, credit cards, and other debts

RELATED: 5 Critical Tips You Must Know Before Buying Life Insurance

AARP Term Life No Medical Exam

Better known as… AARP’s Guaranteed Acceptance Life Insurance

Provides up to $50,000 of valuable permanent group life insurance, exclusively for AARP members. No medical exam is required-acceptance is based on your answers to three health questions, and most who apply are accepted.

- It’s a simple way to get lifetime coverage that can help:

- Pay medical and funeral bills, or other obligations you may leave behind

- Meet everyday living expenses

- Leave a gift or added financial cushion for someone special

AARP’s Permanent Life Insurance

Provides up to $25,000 of permanent group life insurance — acceptance guaranteed* — exclusively for AARP members. There’s no medical exam and no health questions.

This affordable coverage can help:

- Cover medical and funeral expenses

- Pay other bills you may leave behind

- Provide a little extra peace of mind for your family

- Has a standard two year waiting period of coverage however if there is an accidental death, the full payout will be issued from the first day of payment.

AARP’s Young Start Life Insurance

Give a child or grandchild up to $20,000 of affordable life insurance they can keep for their entire lives. AARP Young Start from New York Life Insurance Company is permanent coverage available exclusively to AARP members and offers:

- Whole life policies meaning coverage that can continue for life

- Low childhood rates

- No medical exam, just three health questions

AARP Whole Life Insurance

As you can see, AARP doesn’t offer a vast array of products. AARP Whole Life Insurance is a standard product offered by most insurers but because they do not actually offer life insurance they are limited to what the AARP New York Life partnership offers. If you are looking for flexibility and coverage in excess of $100,000, then AARP is definitely NOT the insurer for you!

AARP Life Insurance Rates

So let’s take a look at how AARP compares to other top life insurance companies!

Here are AARP’s Term rates for Men & Women age 50 – 74:

AARP Term Life Insurance Quotes For Men

Book6.xlsx

| Age | $10000 | $25000 | $50000 | $75000 | $100000 |

|---|---|---|---|---|---|

| 50-54 Years Old | 14 | 26 | 45 | 62 | 79 |

| 55-59 Years Old | 18 | 36 | 65 | 91 | 116 |

| 60 - 64 Years Old | 24 | 50 | 94 | 133 | 171 |

| 65 - 69 Years Old | 31 | 67 | 128 | 182 | 236 |

| 70-74 Years Old | 42 | 95 | 184 | 263 | 342 |

(Based on AARP’s Instant Quotes, as of 10/03/19, subject to change)

AARP Term Life Insurance Quotes For Women

Book6.xlsx

| Age | $10000 | $25000 | $50000 | $75000 | $100000 |

|---|---|---|---|---|---|

| 50-54 Years Old | $11.00 | $18.00 | $29.00 | $41.00 | $52.00 |

| 55-59 Years Old | $13.00 | $22.00 | $38.00 | $54.00 | $69.00 |

| 60-64 Years Old | $17.00 | $32.00 | $58.00 | $83.00 | $108.00 |

| 65-69 Years Old | $21.00 | $44.00 | $81.00 | $118.00 | $154.00 |

| 70-74 Years Old | $33.00 | $74.00 | $141.00 | $207.00 | $272.00 |

(Based on AARP’s Instant Quotes, as of 10/03/19, subject to change)

So I am going to use Banner Life rates, one of our most competitive companies, to illustrate just how much we can save you.

Here are quotes for a 20-year term from ages 50 – 70:

Term Life Insurance Quotes Banner Life Insurance (Male)

Book6.xlsx

| Age | $100000 | ||||

|---|---|---|---|---|---|

| 54 Year Old Male Preferred Non Smoker | $33.18 | ||||

| 59 Year Old Male, Preferred Non Smoker | $33.18 | ||||

| 64 Year Old Male, Preferred Non Smoker | $33.18 | ||||

| 69 Year Old Male, Preferred Non Smoker | $33.18 | ||||

| 70 Year Old Male, Preferred Non Smoker | $33.18 |

(Life Insurance Quotes based for 20 Year Guaranteed Level Term with a Preferred Rating, as of 10/03/19, subject to change)

Term Life Insurance Quotes Banner Life Insurance (Female)

Book6.xlsx

| Age | $100000 | ||||

|---|---|---|---|---|---|

| 54 Year Old Female Preferred Non Smoker | $24.71 | ||||

| 59 Year Old Female, Preferred Non Smoker | $24.71 | ||||

| 64 Year Old Female, Preferred Non Smoker | $24.71 | ||||

| 69 Year Old Female, Preferred Non Smoker | $24.71 | ||||

| 70 Year Old Female, Preferred Non Smoker | $24.71 |

(Life Insurance Quotes based for 20 Year Guaranteed Level Term with a Preferred Rating, as of 10/03/19, subject to change)

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Is AARP’s Simplified Application All It’s Cracked Up to Be?

If you’re too scared to take a medical exam, you’re gonna be much more likely to buy their simplified issue offering.

….but I will bet you dollars to doughnuts that life insurance with a medical exam will get you better premiums in the long run.

They promote this simplified application by only being asked 3 easy questions, so let’s dive into those:

What About Those 3 Easy Questions?

Question 1

In the past 2 years, have you had treatment or medication for or been diagnosed by a doctor as having heart trouble, stroke, cancer, lung disease or disorder, diabetes, liver or kidney disease, AIDS, AIDS-related complex, or immune system disorder?

* This is a yes or no answer.

Question 2

In the past 2 years, for any condition, have you been admitted to or confined in a hospital, sanitarium, nursing home, extended care, or special treatment facility?

* This is a yes or no answer. If yes, please list the date(s) of onset, along with types of treatment, medicine, and dosage.

Question 3

In the past 3 months, have you consulted a doctor or had treatment or diagnostic tests of any type? (Note: You are not required to report negative AIDS or HIV tests.)

* This is a yes or no answer.

…Hold Up, Slick!

AARP has access to databases with your medical records and prescription history. If they find that you had received treatment for cancer, heart disease, currently have a terminal illness or anything else they consider to be serious your application will be rejected. Yep – DENIED.

As you can clearly see, these questions are designed to catch a serious illness. The truth is there is no eluding life insurance agents and companies.

…and even if you do manage to slip through the cracks, your answers to these questions can be broadly interpreted. Honesty is ALWAYS the best policy when it comes to a life insurance application.

If you think you’re sick, apply for life insurance, and mislead the company you choose, your beneficiaries won’t be able to collect their check.

Why? Because that’s fraud.

Every client I deal with knows how I feel about this. It’s VERY important to be upfront and honest from the get-go.

Guess this simplified application isn’t so easy, peasy after all!

Is AARP Life Insurance For You?

As you can clearly see my AARP life insurance review has a couple of bright spots – but their weaknesses definitely outweigh their strengths!

I can completely empathize with someone who thinks AARP is a dream come true.

If you are in poor health and in your 70s and feel you will be turned down for ANY coverage, their simplified application process seems like a gift.

They even offer a guaranteed issue policy, that doesn’t require you to answer any questions AT ALL!

BUT as we all know NOTHING is ever as simple as it seems.

Enter your ZIP code below to view companies that have cheap insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.